Savings and Investment Component

1. Vision of Savings-Based Community Banks

A vision can be seen as a powerful inspiring long-term perspective, which gives a direction, creates a strong identity and leads to appropriate actions. Many development projects often lack such a vision and, consequently, are more driven by solving day-to-day problems than trying to achieve certain clearly defined milestones that lie ahead.

The importance of a vision is to develop it an early stage and to stick to it. It is the glue that holds all stakeholders together. The vision of LCEP’s savings and investment component implies a number of important aspects about the suggested “community bank”. In a mid- to long-term perspective, the community banks:1

- are to be fully owned and managed by the local villagers

- support a wide variety of income generating activities within the villages

- contribute to the empowerment of their members

- raise significantly the socio-economic living standards of their members

- are able to access external financial and non-financial support services, and

- should meet regulatory standards from Afghan authorities.

2. Main Pillars of Savings-Based Community Banks

Based on the long-term vision, the main pillars and fundamental working procedures of the community banks would include:

- a savings based approach: in contrast to current MF practices in Afghanistan it is suggested to initially focus on the mobilization of local financial resources, i.e. collecting savings from SHG members and their families. Studies have shown that villagers have multiple income streams in rural Afghanistan. Rasmussen (2004) reports that nearly 50% of all households have five or more different income streams. A prime objective of the community bank would be the mobilization of this huge potential of local financial resources. At a later stage, after 6-9 months, an internal lending process will be initiated to meet the members’ demands for loans.

- ownership of the community: “ownership” is a well acknowledged principle in MF. However, successful and less successful MF programs can often be distinguished by the degree to which they have implemented the ownership principle. Only too often, people’s ownership is easily taken for granted by the MF promoters. The design of the proposed community bank model heavily builds upon the ownership principle, since the philosophy of the community banks is characterized by self-help, people’s solidarity, and local self-management.

- conformity with the principles of Islamic Law (Sharia): given Afghanistan’s deeply rooted Islamic culture and traditions, and subsequently wide-spread reservations against money as an earning asset, the design of the community bank model needs to be in line with the principles of Islamic Law. The overriding principle of the community bank will be “wealth sharing” sharing with the community bank members and the village in general. The sole purpose of the community banks is to increase social and economic wealth of their members, and thus, the model should be well in line with the present interpretation of the Sharia.

- strong linkages with the literacy, governance, and micro-enterprise component of the LCEP: Savings and credit activities alone are not sufficient to successfully initiate local economic development, and to ultimately fight poverty. Experience elsewhere has shown that MF activities which are well integrated in more holistic programs show better results in terms of impact on the target population. The LCEP design takes this fact into account and foresees strong linkages between the components.

3. Initial Organizational Structure

Under the NSP, the Community Development Councils (CDCs) emerged as an innovative organizational structure. The CDCs have played a vital role in providing various services to the NSP villages, notably the planning and implementation of the block grant program. The community savings box is one of the outcomes of savings and credit activities under the NSP. Small savings are collected from villagers as donations or contributions which are meant to support the villagers to meet emergency needs on an ad hoc basis. While this is certainly a promising start, future savings and investment operations will need to have a clear vision, strategy and organizational structures that will not only gain the confidence from the villagers but are also appropriate to meet their many fold demands for financial services.

The proposed organizational structure is a two tier structure. The first tier are savings and credit self-help groups (SHGs), the second tier consists of various higher level bodies such as the large gathering (General Assembly), a governing body (Committee), and various sub-committees. In a first initial phase, the savings and credit activities are guided by a separate and independent committee within the current CDC structure. At a later second stage, an autonomous community institution with a legal identity will be established. Figure 1 shows the proposed set-up for the first initial stage. The major elements of the proposed organizational set-up will be discussed in more detail below.

To view the initial organizational structure of the proposed community bank, click here.

Large Gathering (General Assembly)

The large gathering (general assembly) comprises all members of the SHGs. A meeting can be held with a month prior notice. The large gathering will be convened minimum once a year (ordinary large gathering). To conduct such a meeting and to make legally binding decisions for all members, it is suggested to agree on both, a minimum quorum of attendance (such as 50%) and a minimum representation of SHGs (such as two third). The ordinary large gathering is to approve the budget and yearly planning, and must review the progress of the previous year's activities. The gathering approves savings and credit general policies and provides guidance to the governing bodies. In addition, this body elects the account and supervision committee as well as the executive governing body.

Governing Body (Committee)

The governing body (committee) is the highest elected body of the community bank. This body is responsible for the day-to-day management of the community bank. The chairman has a key position with high prestige and good reputation. The vice-chairman acts as a deputy to the chairman. The secretary is responsible to well maintain and manage the records and the treasurer assumes all responsibilities in dealing with cash money. In the beginning, the members of the governing body provide services on a voluntary basis with no financial compensation for their work. With the increasing volume of work load, there should be some scope to hire a part time and a full time manager depending on the capacity of the community bank to pay for their salaries. The governing body meets regularly after the completion of all SHG meetings with the purpose of making final decisions on SHG members' demands and issues.

Savings and Credit Self-help Groups

Savings and credit self-help groups will be formed with support of LCEP and the participation of CDC leaders at the cluster level. At a later stage the governing body will take responsibility for the SHG formation. Representatives of households join a group and elect their group leader, group secretary and representative for the governing body.

Sub Committees

The savings and credit governing body (committee) can form different types of sub-committees for special tasks such as e.g. the formation of a sub-committee to introduce child box savings or a loan sub-committee to make the loan appraisal process more effective for the community bank and its clients. The account and supervision committee is another important committee. Its members are elected by the large gathering (general assembly) and are responsible for internal control. This body checks the records of savings and credit activities regularly and produces reports to the governing body and to the large gathering. The committee comprises one coordinator and two members. Into this body any SHG member can be elected, the only pre-condition is the person must have some accounting knowledge. The coordinator of the account and supervision committee must be a member of the governing body.

Use of “Service Fees” instead of “Interest”

The savings and credit activities need to be in line with the Islamic law (sharia) to gain acceptance by the local communities. It is thus proposed to incorporate two major principles of Islamic finance into the design of the community bank. The first principle is the “murabaha”, which considers the cost of a business plus a mark-up to achieve a surplus from the business operations. Applying this principle to the community bank, it transfers into the use of a fee-based system. This service fee charging system is presently common among MFIs in Afghanistan and appears to be well accepted by the clients. As MF managers noted, it only needs to be well explained to the clients.

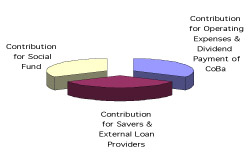

The second principle is the “wealth sharing” principle. This principle is based on considerations of fairness and justice. An Islamic bank is not only perceived as a financier by its clients but also as a partner in business (Elhadj, 2001). As such, a financial institution has also the responsibility to raise the welfare of its clients through e.g. profit sharing. Figure below shows how the collected service fees of the community bank should distribute into three distinguished areas, thus benefiting members, depositors and the shareholders.

Major wealth sharing components of service fee income

The first contribution is for savers with terms and conditions to be agreed by the large gathering (general assembly). The second contribution is for self-help groups who receive a kind of social fund to finance community development activities or to support members in emergency situations. The third contribution is a dividend payment that goes to the equity holders, i.e. the members of the community bank, if the income from the service fees exceeds the administrative and financial costs associated with the management of the community bank.

The wealth sharing principle, to the best knowledge of the consultants, would be an innovation for the MF practices in Afghanistan. So far any generated surplus by a MF NGO was consumed by the organization itself. In contrast, the community bank would share any surplus with its members (the shareholders), the savers and the community at large. Against this background, it is assumed that the community bank model will be fully endorsed and perceived to be well in line with the principles of the sharia. Similar to other MF programs, the approach will require to be well explained to all the stakeholders.

4. Process of Establishing Community Banks

Establishing community banks is certainly a challenging task. However, NSP’s experience with the establishment of CDCs and the positive response to this approach from the communities, clearly shows that building pro-poor institutions in rural Afghanistan is possible.

Core aspects in building community banks

The foundation for the establishment of strong pro-poor community banks will be laid by LCEP during the first two-year implementation phase. In this phase, the priority will be on the formation of savings and credit SHGs at the cluster level. In each community, those SHGs would be federated at the community level (i.e. the second tier) into a governing body, a large gathering and various sub-committees. Throughout this period, the members of SHGs will be trained to handle their own affairs on the group level, and village leaders will be trained to manage the affairs of the governing body and of the various sub-committees.

After two years, and depending on the achievement of certain milestones2, the informal community banks could be registered with an appropriate legal status as a village level organization. The registration itself is a mere formal act. The transformation into an autonomous institution will allow the community banks to gradually increase the scale of their services. It is also part of the empowerment process of the communities showing the decreasing level of dependence on the LCEP and on other support organizations.

The community banks could try to get access to external funding organizations such as MISFA or other banks to increase their capital in order to finance investment opportunities in the communities. Depending on their progress and maturity, the community banks could even try to establish their own apex body at the district/provincial and/or national level at a later stage. The apex body would lobby for the interest of the community banks and their members and would try to replicate the approach throughout Afghanistan. The emergence of a potential national apex body of community banks should, however, not be a priority for the LCEP at this point.

5. Guiding Principles in Product Development

Introducing new savings and loan products into a program is generally considered to be a very challenging task. The following principles are suggested to LCEP to provide some guidance to this process:

- involvement of CDC and SHG members: already in the design phase it is important to involve the target population as early as possible into the development of the product features. An early feedback about the appropriateness of certain products will help to avoid disappointments at a later stage.

- simplicity of product features: any savings or loan product must be very simple and easy to understand for members and group organizers. Particularly in the beginning the complexity of products should be rather low and correspond to the members’ capacities in dealing and managing these products.

- cost recovery: cost coverage is an essential principle that will allow the organization to operate on a long-term basis. Any product must be properly priced, that is the amount of compensation or profit sharing with the depositors need to be carefully calculated. Similarly, the fee charged on borrowers must be calculated in a way that will allow to cover the costs of the organization and to share some of the surplus with the stakeholders:

- regular collection and discipline: as Prof. Yunus, the founder of the Grameen Bank in Bangladesh, once said, “credit without discipline is charity”. Discipline is one of the most important principles in MF. Programs lacking commitment to discipline are unlikely to achieve their goals. Discipline in the case of LCEP will mean regular participation of members in SHG meetings, placement of regular savings as per agreed time intervals, and regular payment of loan installments.

- pilot-test products: before its introduction, any new product should be pilot-tested within a certain area. This will allow to see the market response and to give time for some corrective adjustments to product features, if necessary.

- “less is more”: in the beginning it is important to concentrate on doing and introducing a few selected and important savings and loan products only. Introducing many products at a time will most likely overstretch the capacities of LCEP and the communities.

6. Potential Products Offered by Savings-Based Community Banks

Past MF activities within the framework of the NSP have taken place on a rather limited scale. Past efforts were directed to mobilize and provide social and emergency funds only to individual villagers. To scale up the savings and investment component, activities to a meaningful level, new products that effectively serve to various needs of the community bank’s clients, will become necessary. The following products have been developed after several meetings with NSP group organizers and are proposed to LCEP to be considered for implementation, taking into account the above guiding principles:

Sandoq (Compulsory Group Savings)

Sandoq is a traditional compulsory savings product that is well know in the NSP communities. This savings product is managed by the savings and credit SHG members who regularly provide a certain amount of money into the group fund.

Individual Pass Book Savings (Withdrawable)

Individual Pass Book Savings is classified as withdrawable savings. This product is recommended for introduction after the first large gathering (general assembly) has taken place. The new feature of this product is that members are free to deposit and withdraw money according to certain prescribed rules and regulations of the community bank.

Social Fund at SHG Level

Social fund at the SHG level supports the values of the traditional informal Afghan practices. This fund is closely linked with the group guarantee loan. When SHG members pay a service fee, an agreed portion of the fee will be channeled to the SHG social fund. In addition, SHGs can allow additional non-refundable regular small contributions from SHG members. SHGs are free to use this fund according to their needs with formal approval of the governing body. A major purpose of the social fund is to provide emergency loans to SHG members.

Group Guarantee Loan

A group guarantee loan is a loan for income generation activities, only. Loans for emergency and consumption purposes should be provided through the wealth sharing and social fund. The group guarantee loan is granted on the recommendation of the SHG with formal approval of the governing body. The loan will be disbursed from the governing body’s office. Loan installments and service fees will be collected at SHG meetings and the governing body’s office.

Emergency Loan (through the Social Fund)

The emergency loan is a special loan catering for social or consumption needs of SHG members. Apart from income generating activities, members may require loans to meet their emergency requirements, e.g. for medical expenses or for social activities. Inherently, these activities by its nature will not generate a surplus. Thus, it may be more difficult to repay a loan for “social” purposes than for an income generating activity.3 To cater for these needs, the consultants propose a loan product that is closely linked with the social fund. Loans from this fund could be given at preferential rates to members.

In addition to the above outlined savings and credit products, the community bank could gradually introduce over time, depending on the maturity of the organization, more sophisticated products, such as: Savings for specific purposes (e.g. education), insurance (e.g. health, livestock), long-term loans, loans for specific purposes such as housing

7. Record Keeping System of Savings and Credit Services

A good record keeping system takes track of all financial transactions that take place on the level of the SHG member, the SHG, and the organization. The record keeping system helps to produce the necessary information which is the basis for decision making, reporting, and planning and evaluation. The record keeping system should generate information both for internal and external users.

Transparency of all financial activities is an important issue for SHG members and the community bank in general. It is only through sufficient transparency that the local people will find trust and confidence into the operations of the community bank. Given the low levels of formal (and even informal) education in rural Afghanistan, the record keeping system of the LCEP MF component needs to be as simple as possible, corresponding to the human resources capacities of the local people.

A record keeping system can be divided into two distinct parts: a financial record and a non-financial record keeping system. The financial record keeping system refers to the transactions of money. The non-financial record keeping system comprises a full range of documents related to the operation of a community bank, e.g. minute books, member registers, application forms, etc.

- This text is an excerpt from a larger document produced by UN Habitat for LCEP in 2005.

- Milestones could include for example a critical minimum amount of members, outstanding loan volume, amount of generated internal financial resources, ownership, cost-coverage, etc.

- At this point, it may be appropriate to remind the reader once again that studies have shown multiple income streams for rural households in Afghanistan. Thus, even for social purpose loans rural households might have a sufficient repayment capacity.